Mo Sales Tax Calculator

Tax Calculator - Missouri

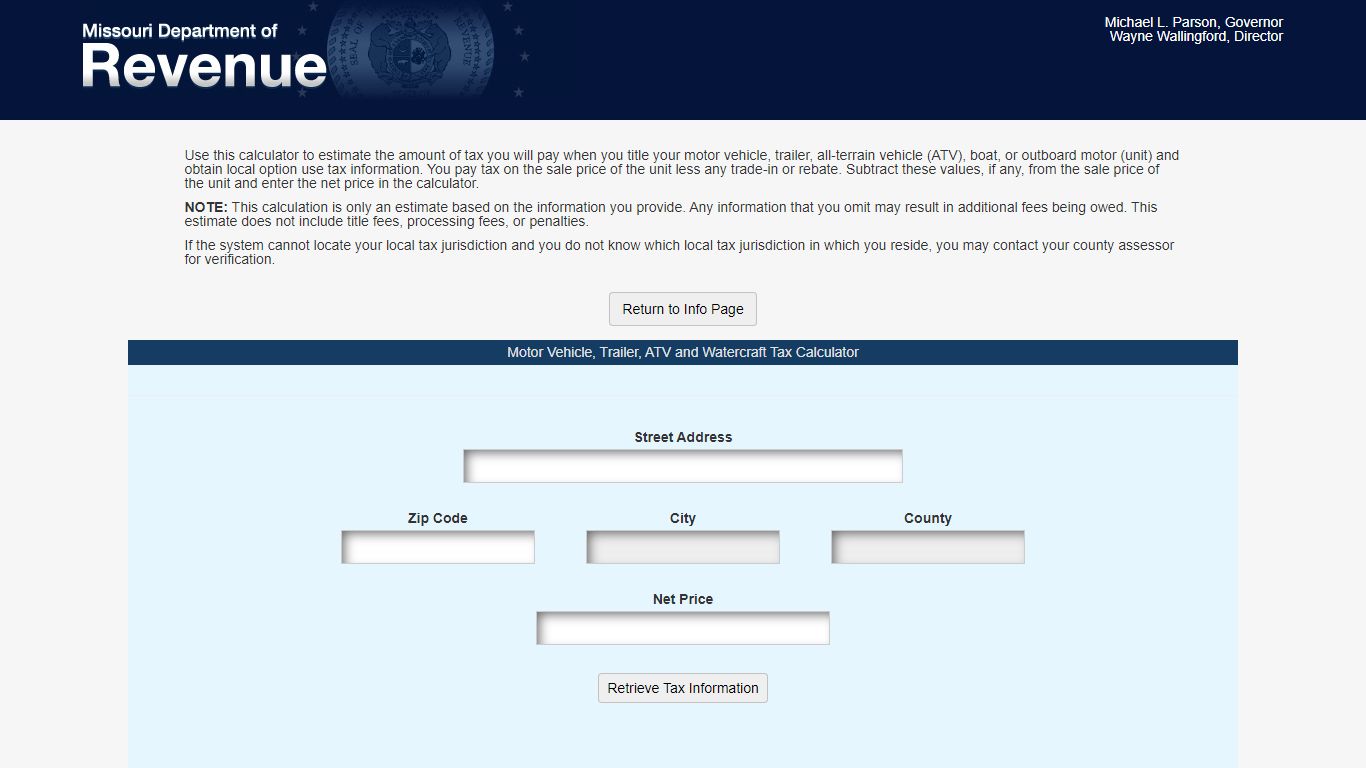

Tax Calculator. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle, trailer, all-terrain vehicle (ATV), boat, or outboard motor (unit) and obtain local option use tax information. You pay tax on the sale price of the unit less any trade-in or rebate. Subtract these values, if any, from the sale ...

https://sa.dor.mo.gov/mv/stc/

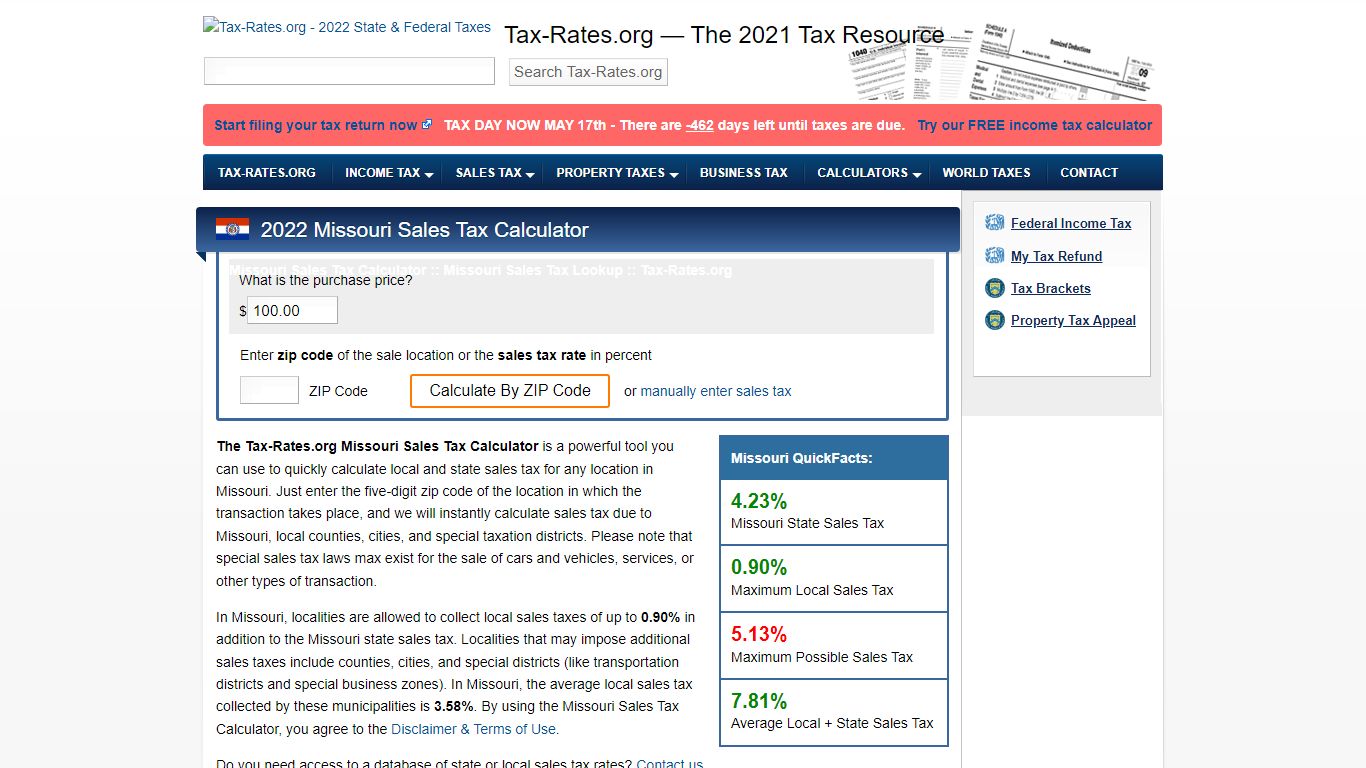

Missouri Sales Tax Calculator - Tax-Rates.org

Missouri State Sales Tax. 0.90%. Maximum Local Sales Tax. 5.13%. Maximum Possible Sales Tax. 7.81%. Average Local + State Sales Tax. The Tax-Rates.org Missouri Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Missouri. Just enter the five-digit zip code of the location in ...

https://www.tax-rates.org/missouri/sales-tax-calculator

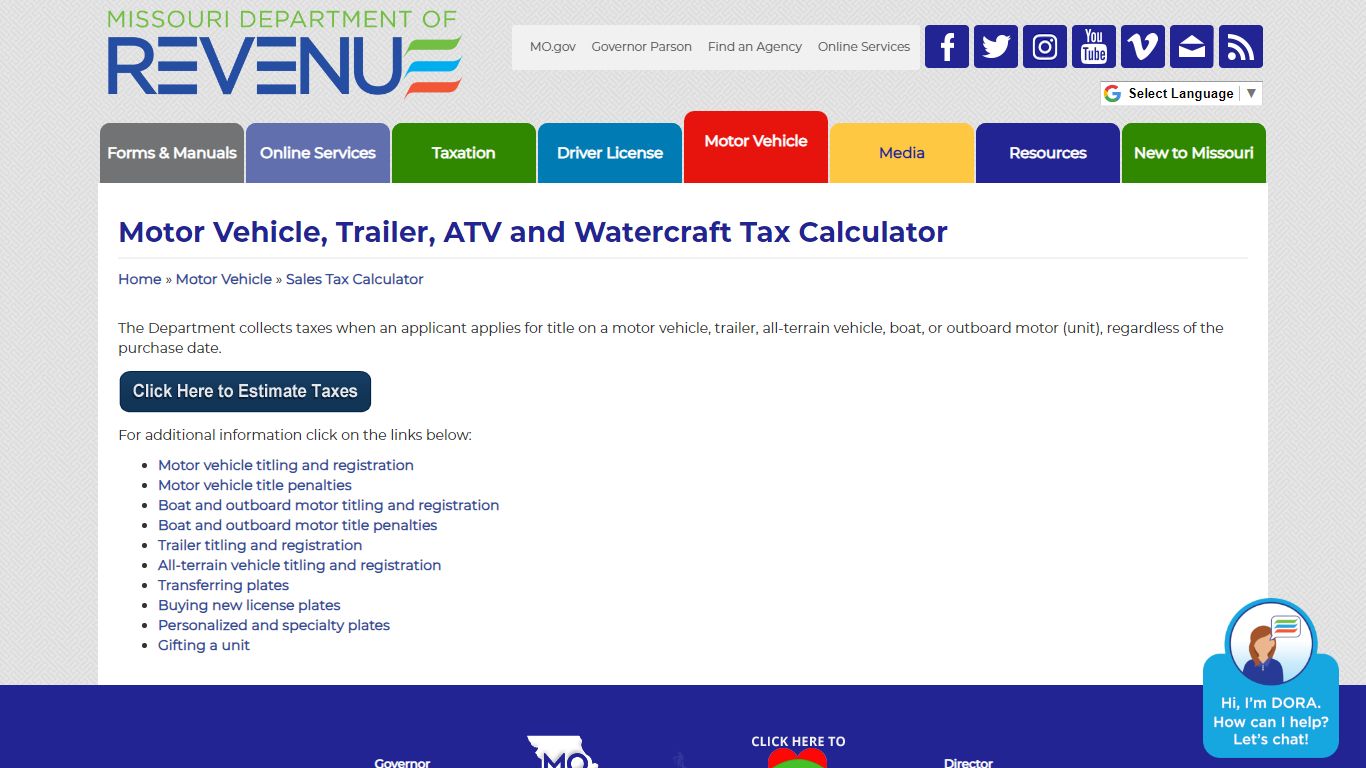

Motor Vehicle, Trailer, ATV and Watercraft Tax Calculator - Missouri

Home » Motor Vehicle » Sales Tax Calculator. The Department collects taxes when an applicant applies for title on a motor vehicle, trailer, all-terrain vehicle, boat, or outboard motor (unit), regardless of the purchase date. For additional information click on the links below: Motor vehicle titling and registration.

https://dor.mo.gov/motor-vehicle/sales-tax-calculator.html

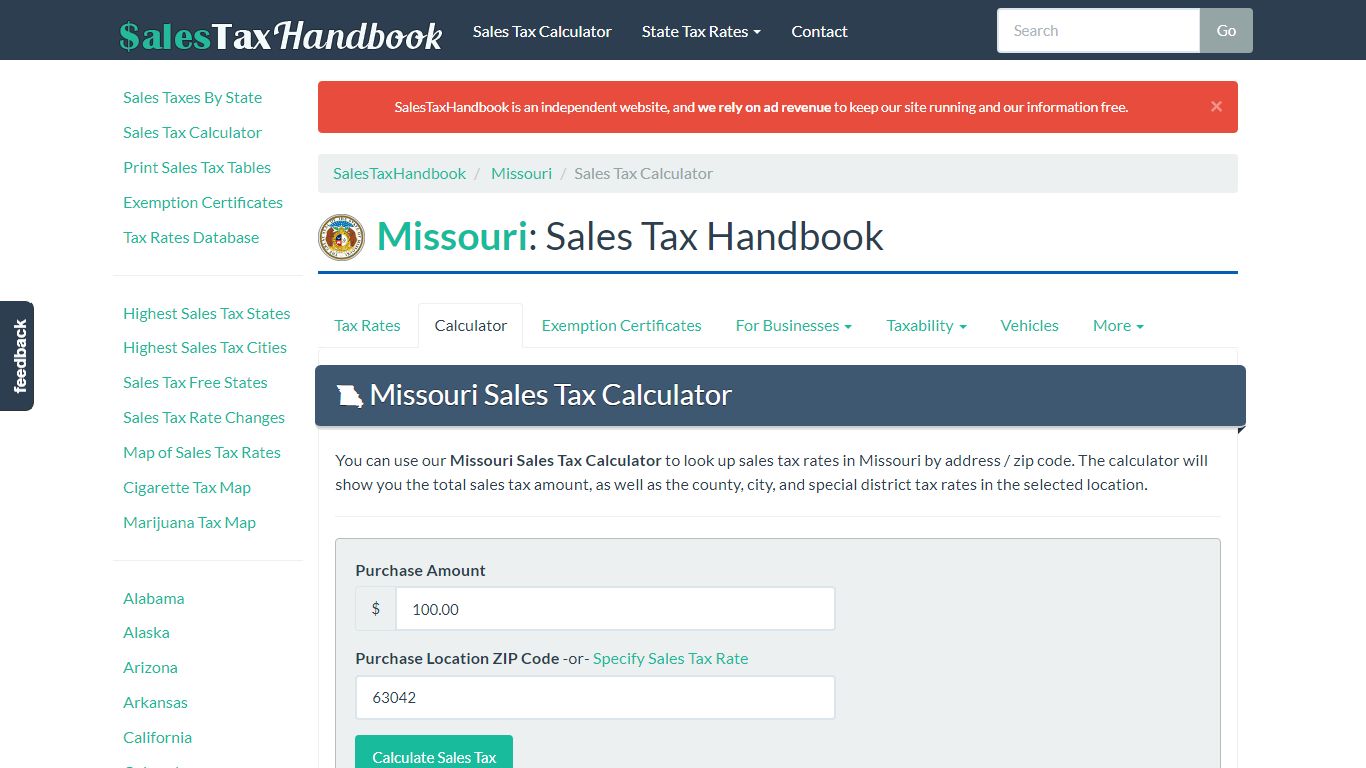

Missouri Sales Tax Calculator - SalesTaxHandbook

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Missouri has a 4.225% statewide sales tax rate , but also has 741 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.68% on ...

https://www.salestaxhandbook.com/missouri/calculator

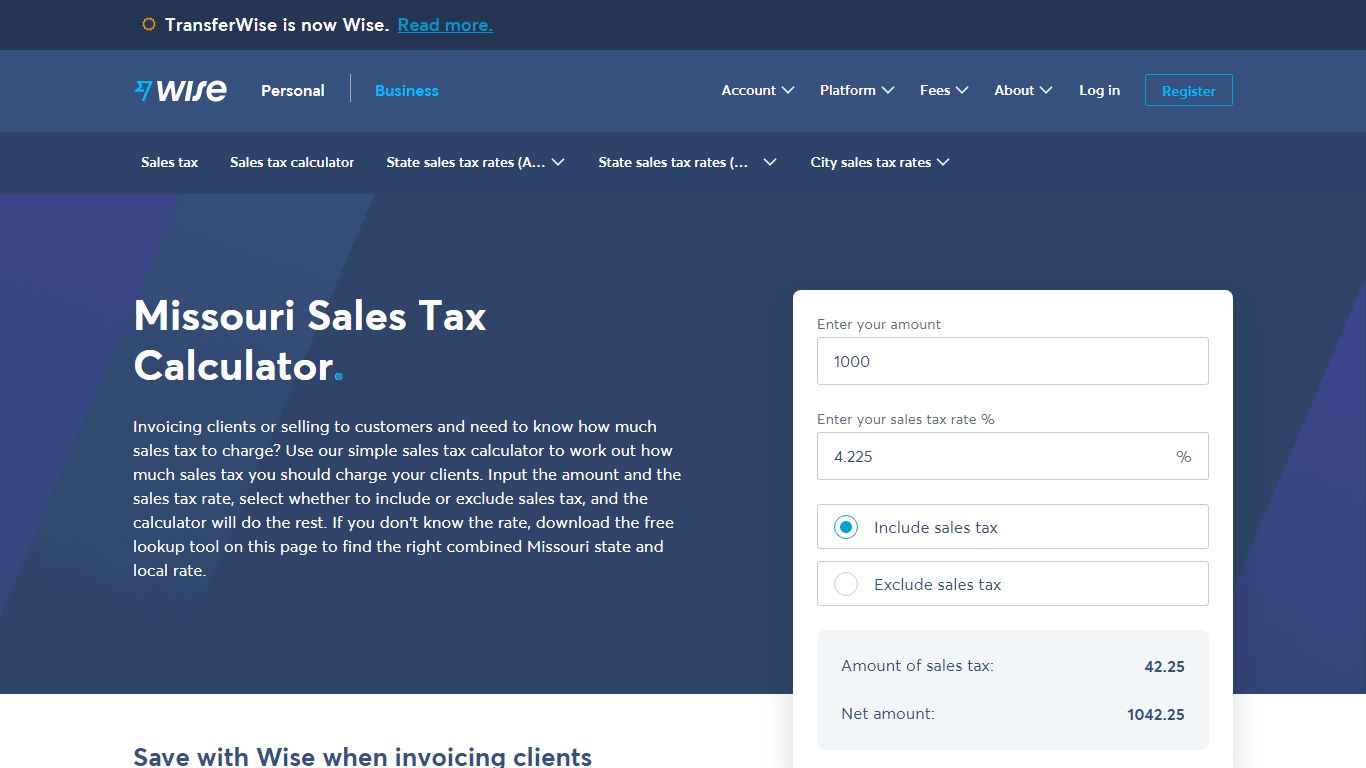

Missouri Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Missouri is 4.23%. Local tax rates in Missouri range from 0% to 5.875%, making the sales tax range in Missouri 4.225% to 10.1%. Find your Missouri combined state and local tax rate. Missouri sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a ...

https://wise.com/us/business/sales-tax/missouri

Tax Calculators - Missouri

Tax Calculators. Home » Calculators. Use our handy calculators linked below to assist you in determining your income tax, withholding, or penalties for failure to file or pay taxes. Additions to Tax and Interest Calculator. Income Tax Calculator. Sales/Use Tax Bond Calculator. Withholding Calculator.

https://dor.mo.gov/calculators/

Sales Tax Calculator - Mo-SuperTools - Mo-SuperTools

The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation. Vermont has a 6% general sales tax, but an additional 10% tax is added to purchases of alcoholic drinks that are ...

https://mo-supertools.com/sales-tax-calculator

Sales/Use Tax - Missouri

The 4.225 percent state sales and use tax is distributed into four funds to finance portions of state government – General Revenue (3.0 percent), Conservation (0.125 percent), Education (1.0 percent), and Parks/Soils (0.10 percent). Cities and counties may impose a local sales and use tax. Special taxing districts (such as fire districts) may ...

https://dor.mo.gov/taxation/business/tax-types/sales-use/

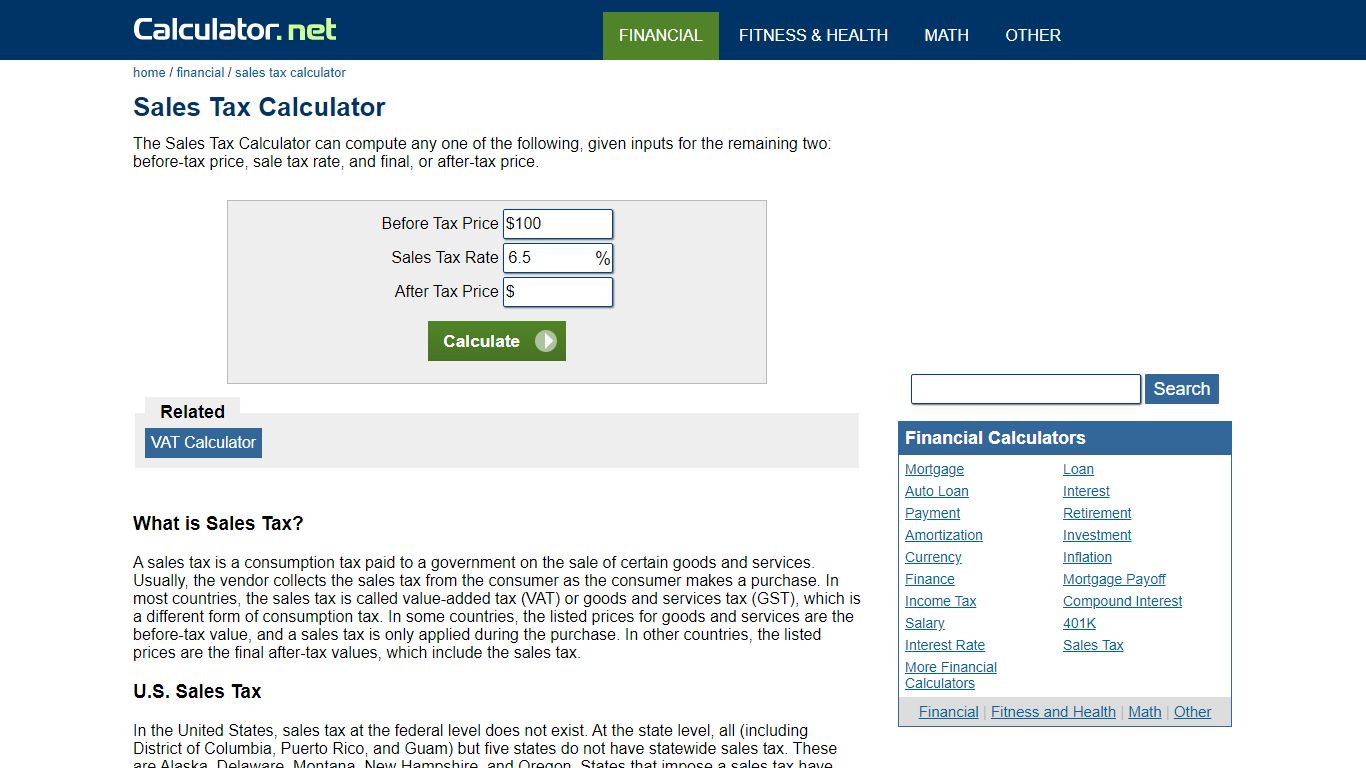

Sales Tax Calculator

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax.

https://www.calculator.net/sales-tax-calculator.html

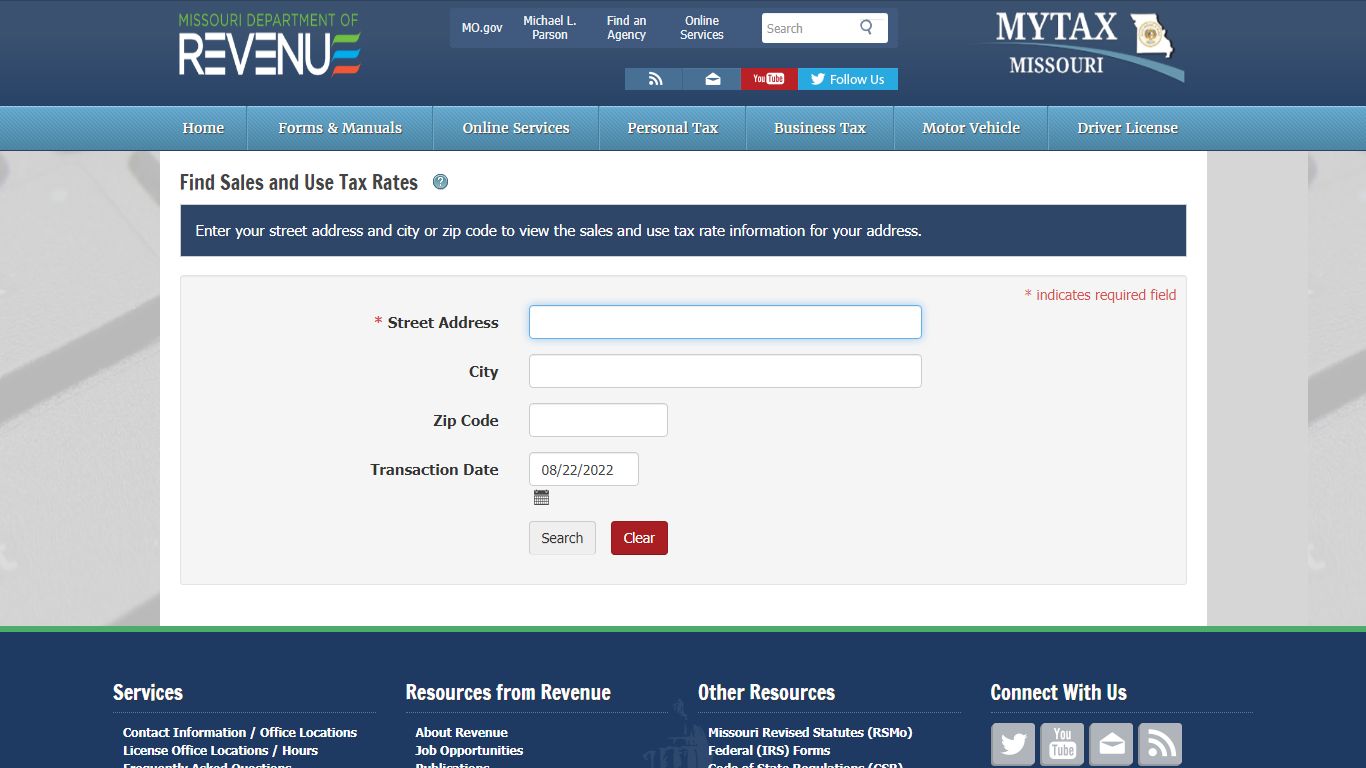

Find Sales Use Tax Rates - Missouri

Find Sales and Use Tax Rates. Enter your street address and city or zip code to view the sales and use tax rate information for your address. * indicates required field. Street Address. City. Zip Code. Transaction Date.

https://mytax.mo.gov/rptp/portal/home/business/customFindSalesUseTaxRates